The American Jobs Creation Act of 2004 (2004 Act) imposed new penalties on taxpayers who fail to adequately disclose “reportable transactions” to […]

A Reportable Transaction

A Reportable Transaction is generally a transaction of a type that the IRS has determined as having a potential for […]

Transactions of Interest

Notice 2007-72 – August 14, 2007 – Contribution of Successor Member Interest – This transaction involves a taxpayer directly or indirectly […]

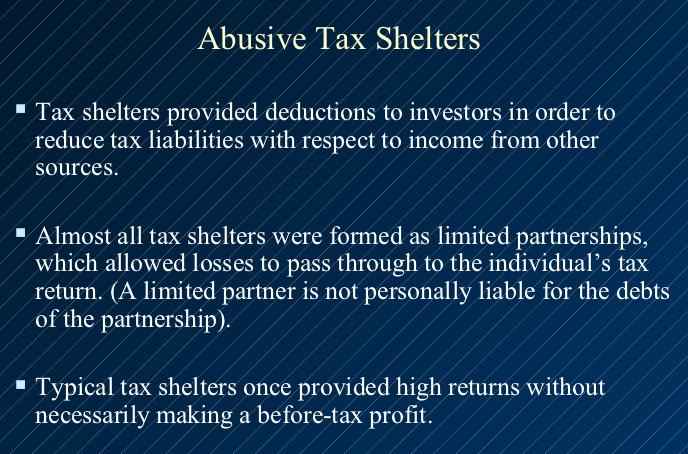

Listed Abusive Tax Shelters and Transactions

Revenue Ruling 90-105 – Certain Accelerated Deductions for Contributions to a Qualified Cash or Deferred Arrangement or Matching Contributions to a […]

IRS to Combat Abusive Tax Shelters and Transactions

The Internal Revenue Service has a comprehensive strategy in place to combat abusive tax shelters and transactions. This strategy includes […]

Form 8886 is Required

Form 8886 is required to be filed by any taxpayer who is participating, or in some cases has participated, in […]

Section 79 Plans and Captive Insurance

Insurance companies, agents, financial planners, and others have pushed abusive 419 and 412i plans for years. They claimed business owners […]